2.0 Tax Filling Listing

How to set up an SST Applet?

-

Create Tax Year

-

Company → Fill in Organization Applet - Company

-

Fiscal Year → Fill in Chart of Account Name → A short description on the company and SST Filing period

-

Filing Cycle Duration → SST Filing Period

-

-

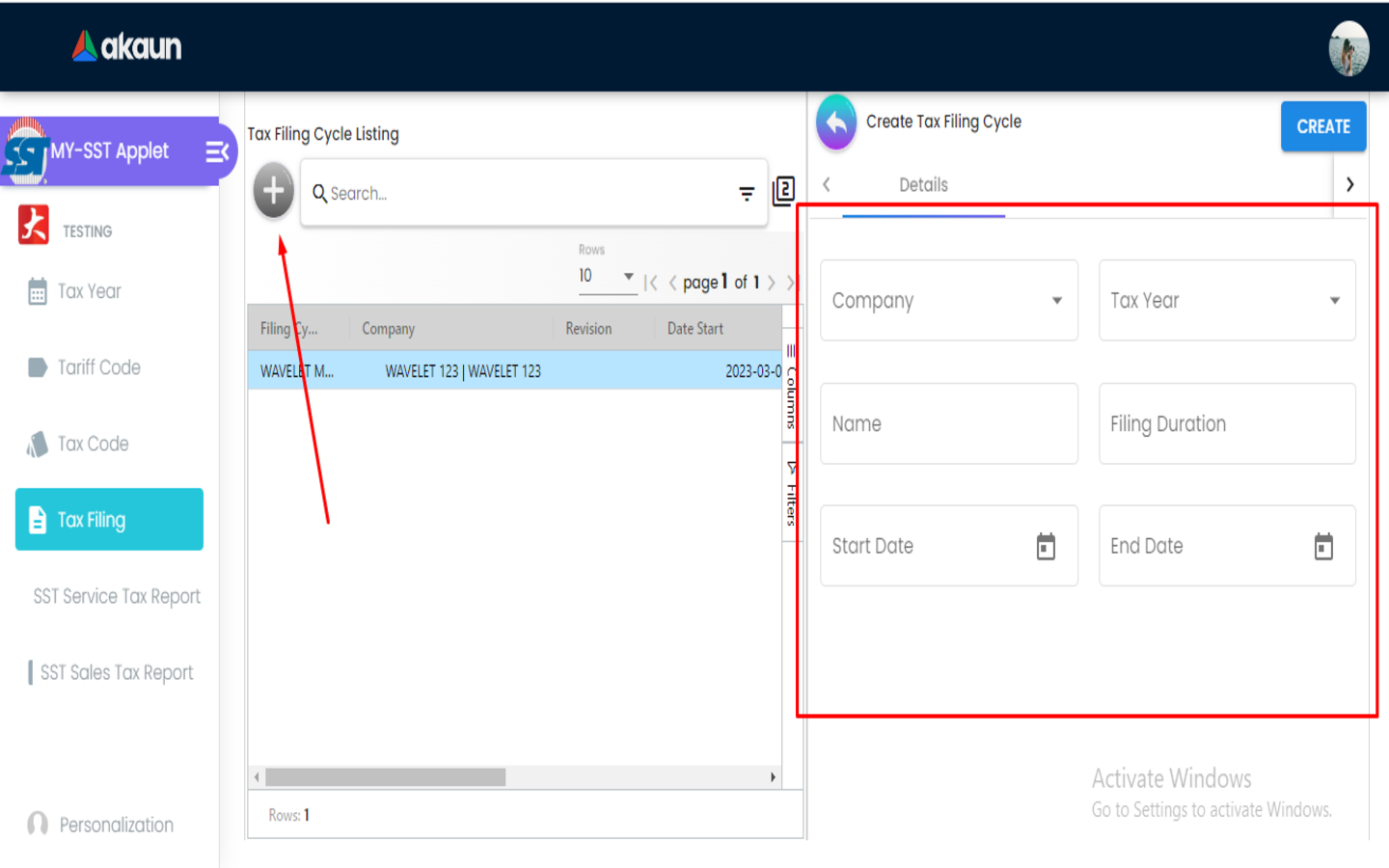

Create Tax Filing

-

Create the tax filing and fill in all the details accordingly.

-

-

In Doc Item Maintenance Applet → make sure that all the items and pricing scheme are correct.

-

In Internal Sales Invoice Applet → make sure that all the invoice is correct, with the correct SST.

-

Make sure that the invoice we want to file is finalize in Internal Sales Invoice Applet (click “FINAL”)

-

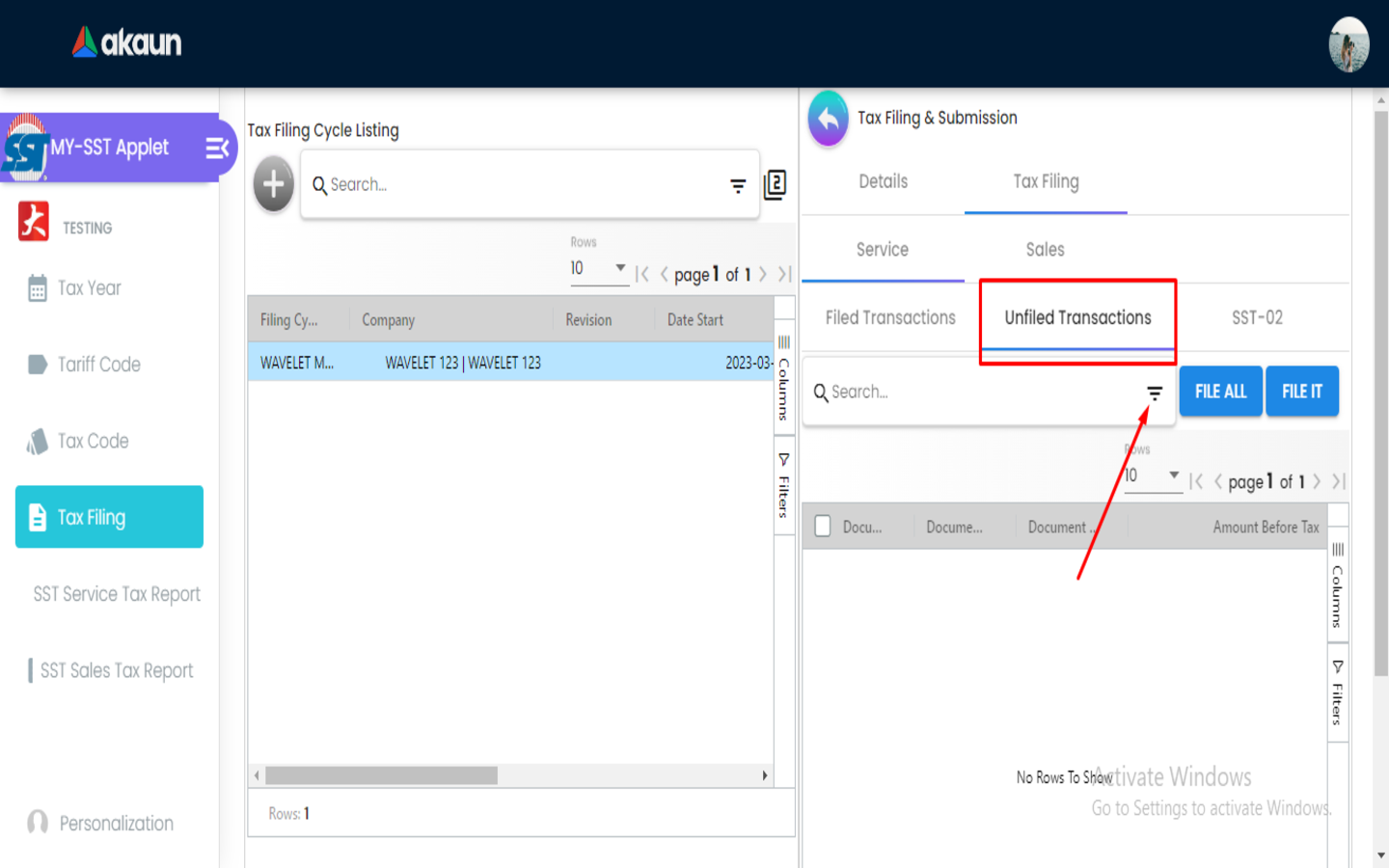

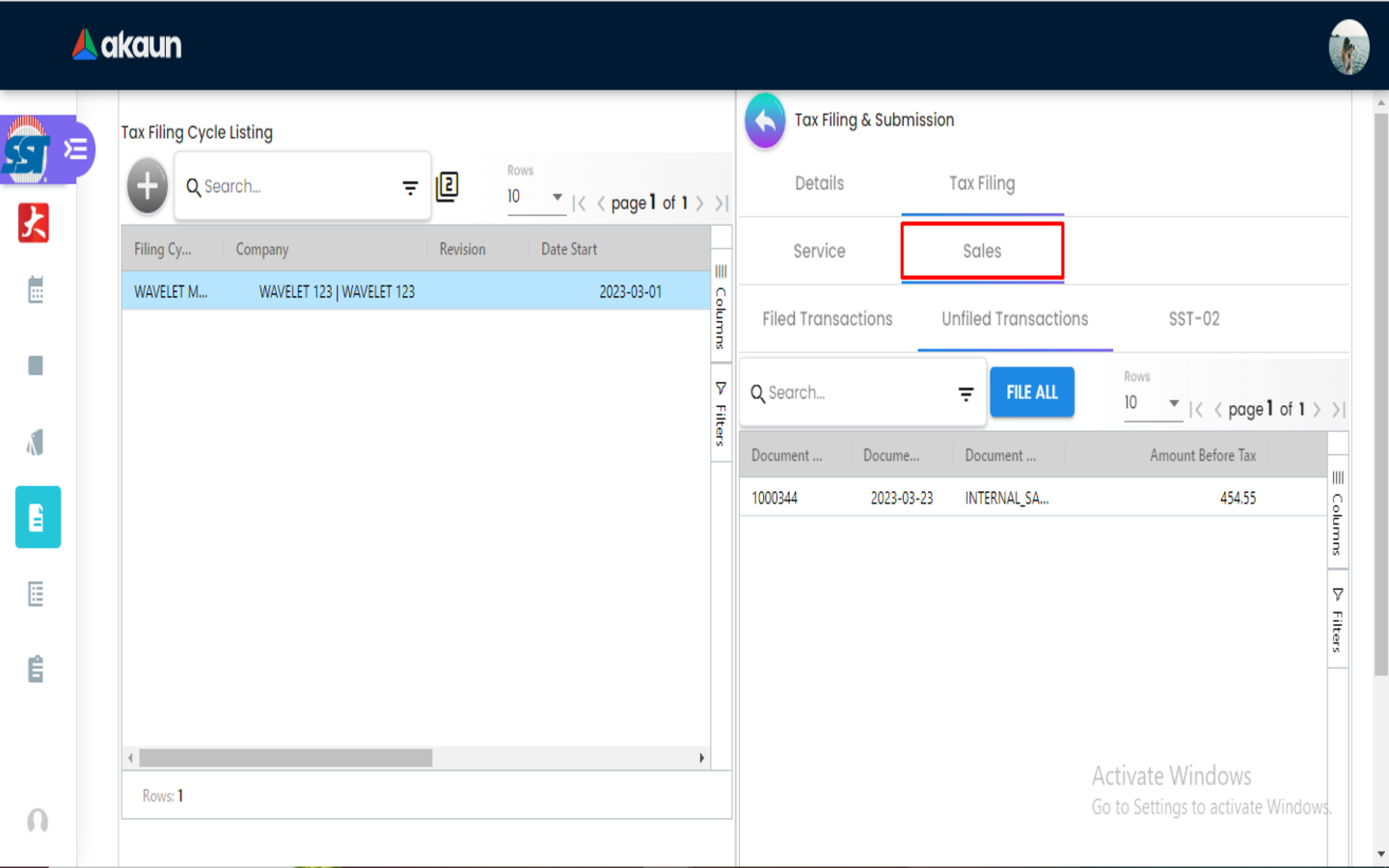

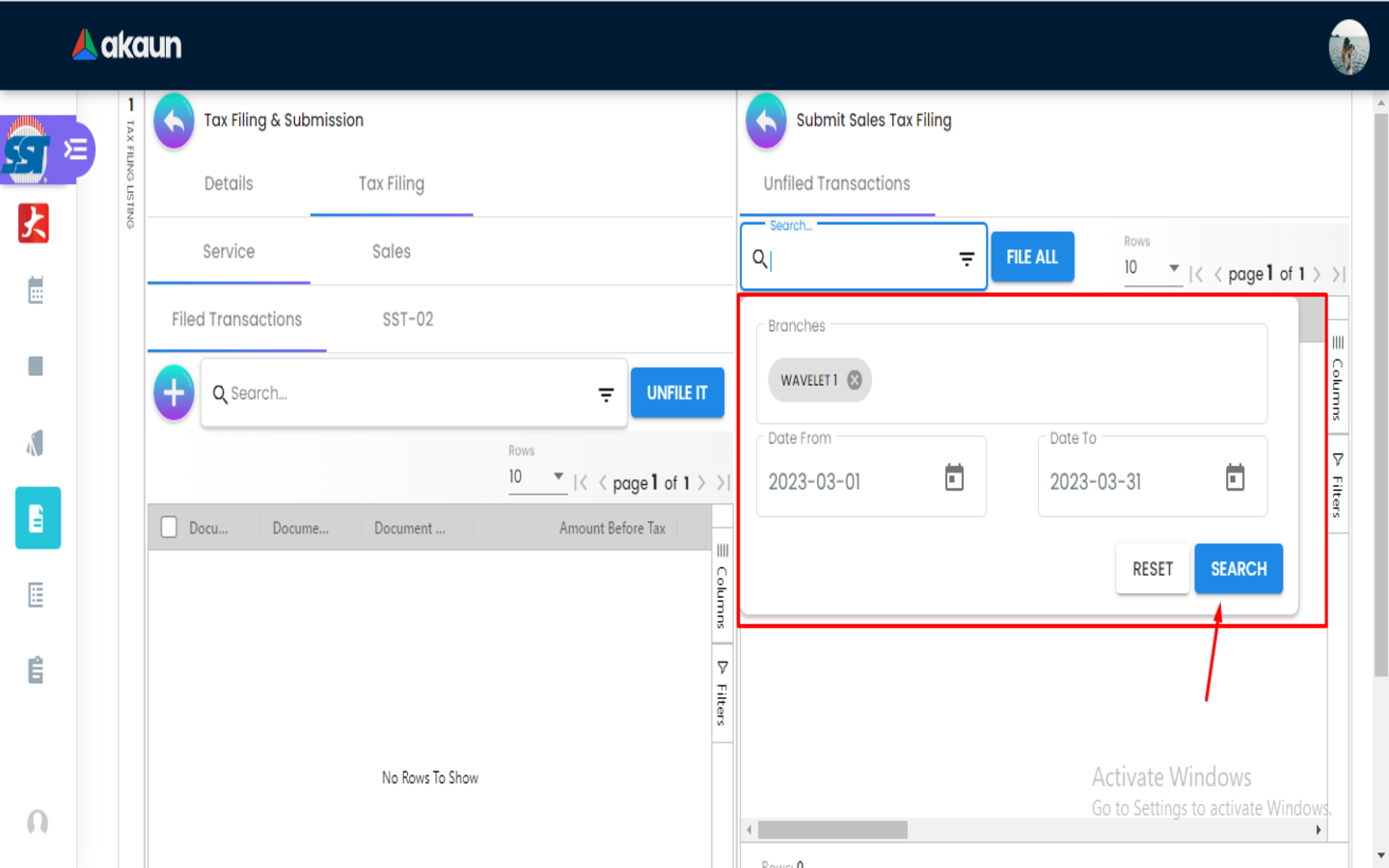

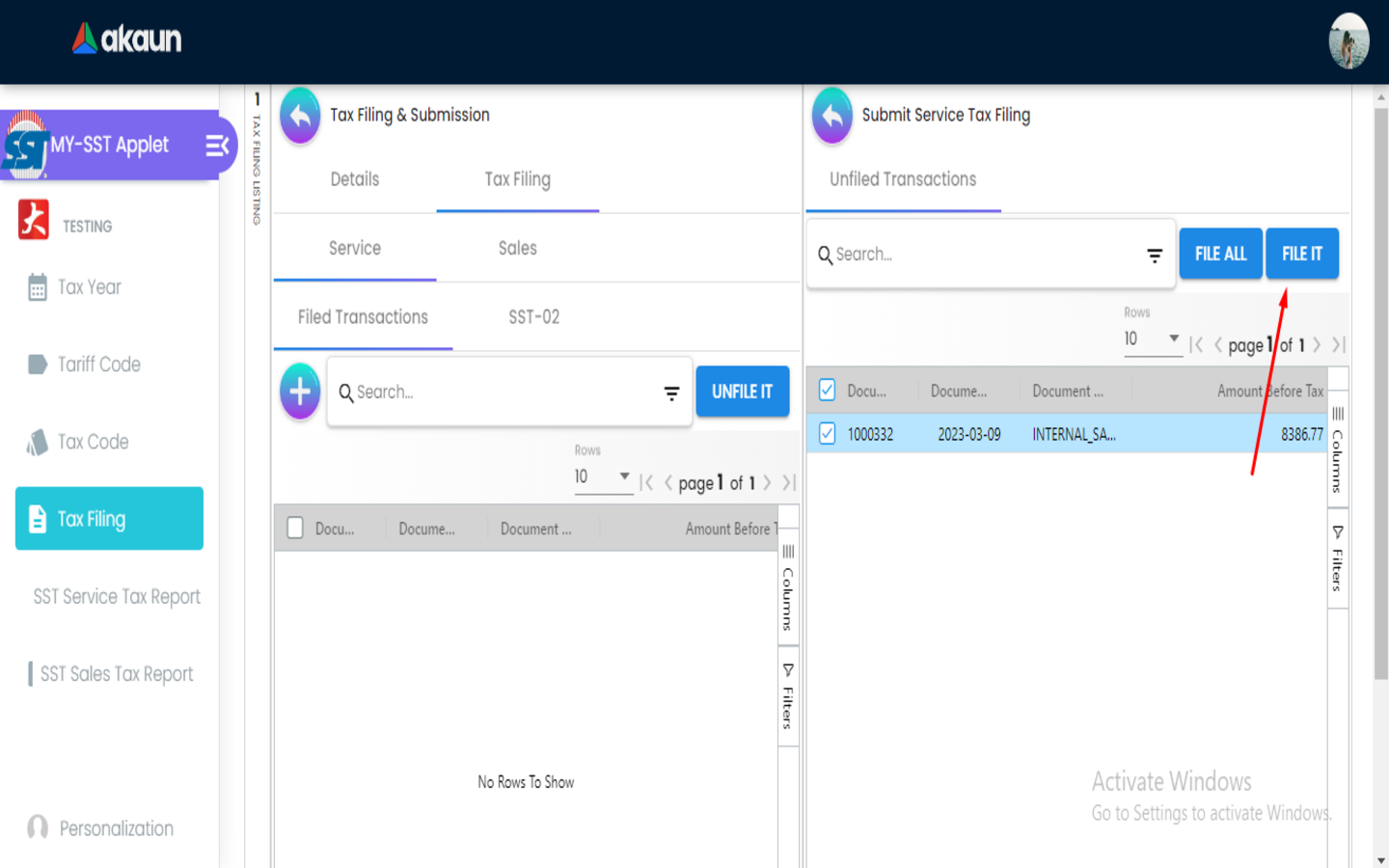

Go to SST Applet →Check whether the SST code is for service or sales and select accordingly → Click on unfile txn → click on the filter → choose the branch and date accordingly → search

-

The sales invoice we generate with SST code should come out and we need to file all the related documents.

-

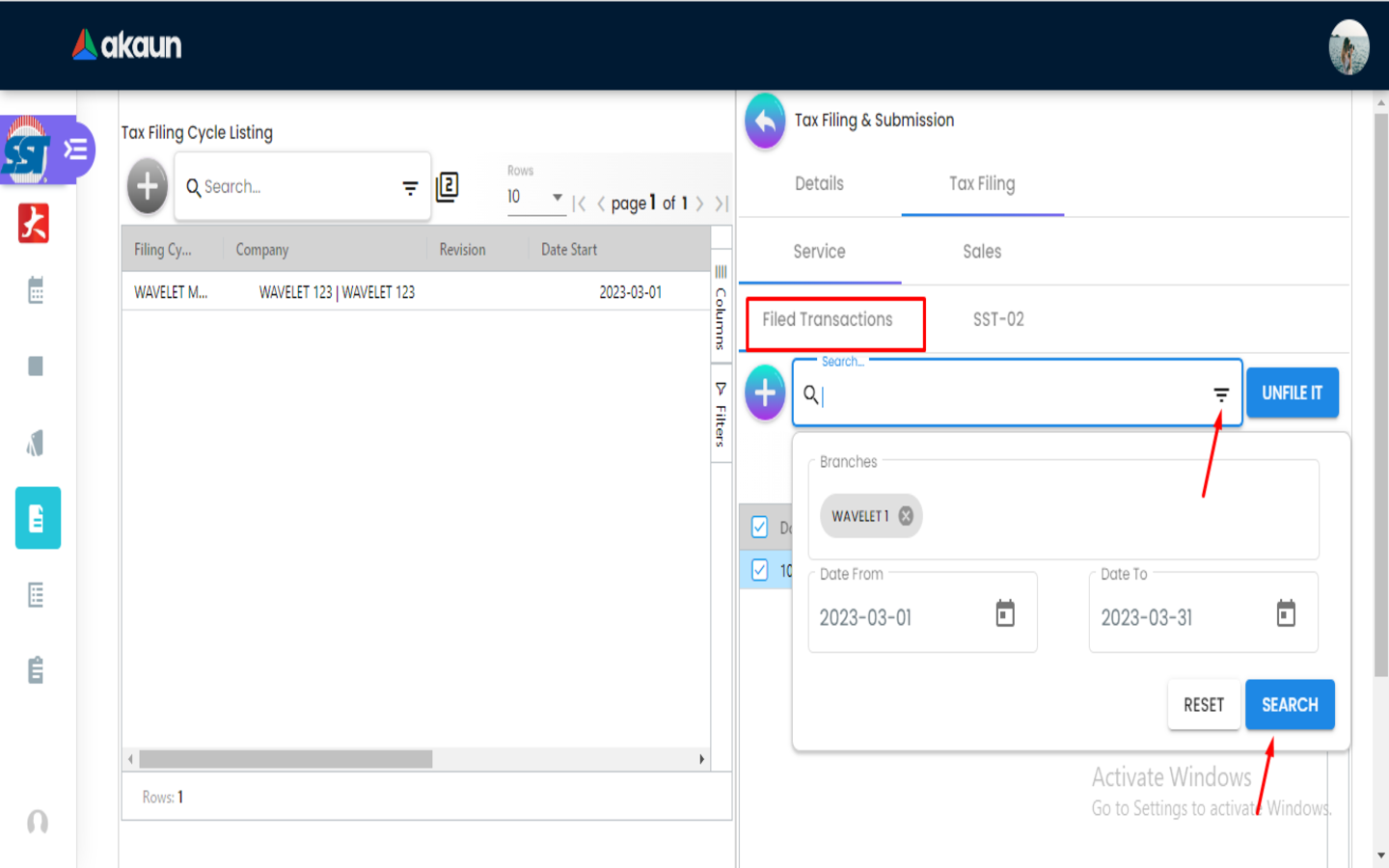

Go to filed transaction → filter button (still discussing with Ida whether to set the report as default) → search and the filed items will filter out accordingly.

-

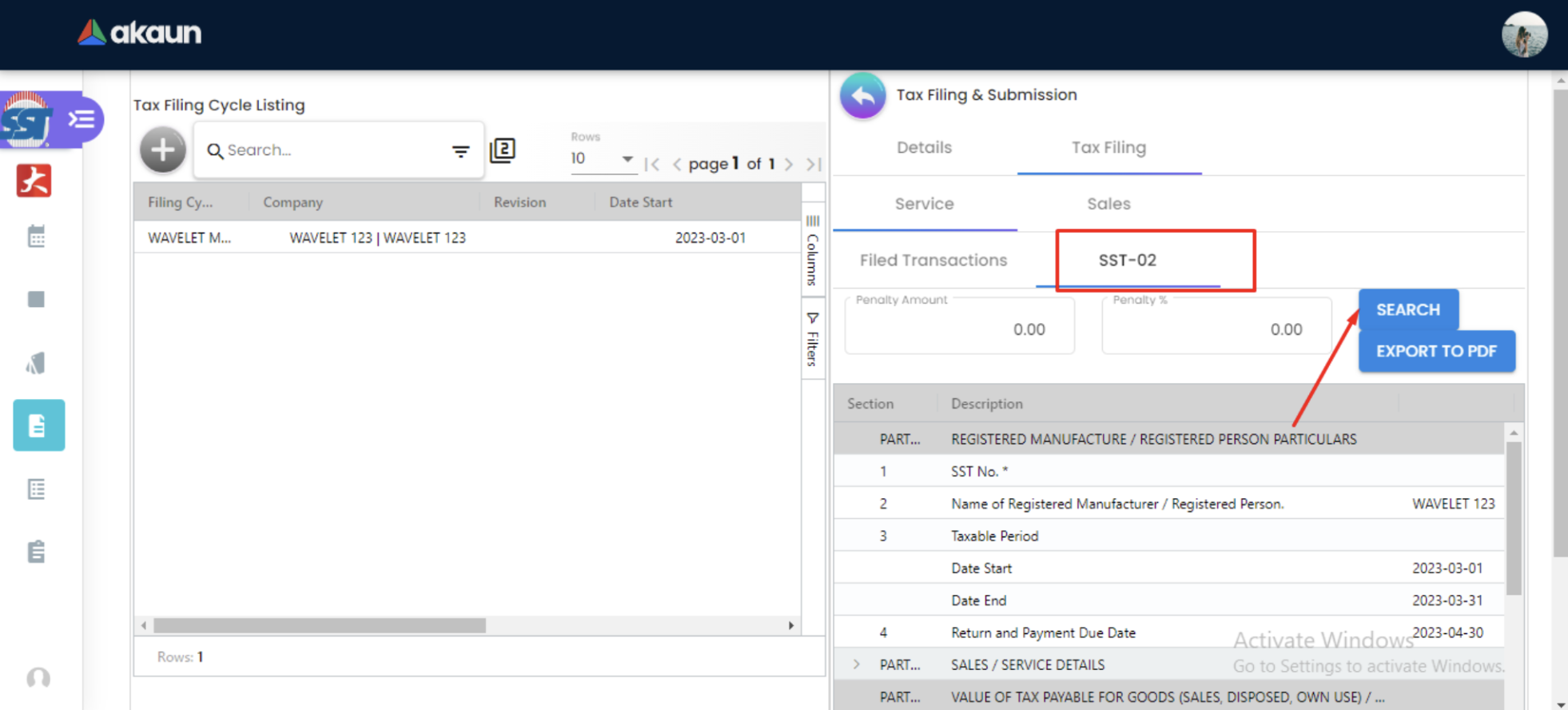

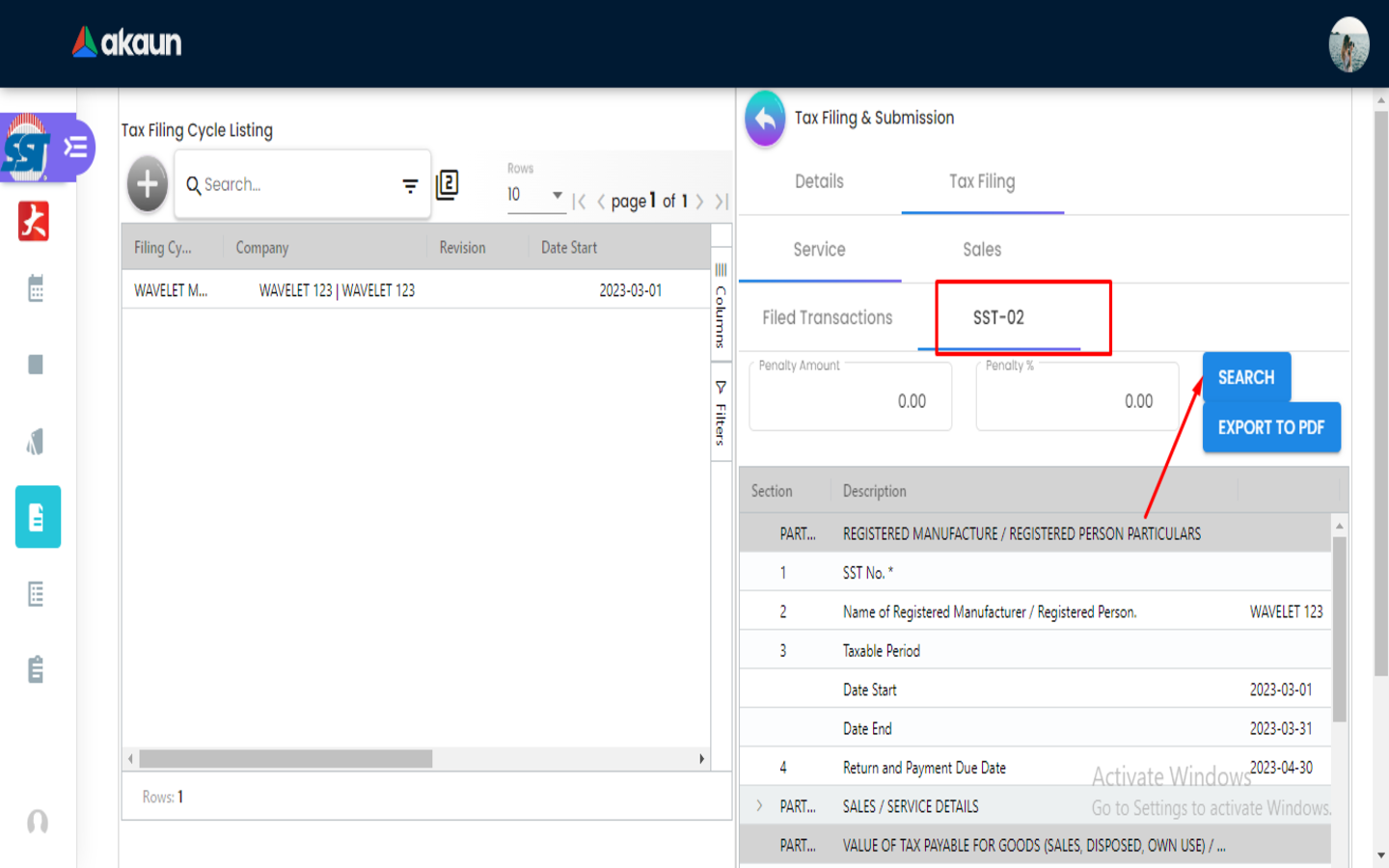

To generate SST - 02 report, click on “SST-02” → click “search”